Do you remember the last time you stepped into your local bank for a transaction?

Not more than few years ago were customers pacing to banks for trivial transactions. Today, in under 10 years, technological advancements turned the Banking sector 180 degrees. The rise of new technologies has made almost every bank transaction online and available 24/7.

Why Banking needs Digital Transformation?

Customer expectations, digital disruption, and emerging competitors are pressurising banks to remodel their innate services to digital.

Blockchains, IoT with mobile applications, chip-based cards, tap-based cards, are the technology supporters putting banks back in their old game with more strength to meet the future. Adopting core digital processes enabled banks with seamless processes, reduced costs, and elevated customer engagement. Notably, most Banking firms are sprinting to make the most of digital transformation; while the fact remains that there are numerous players still caving in, struggling with manual processes and long queues.

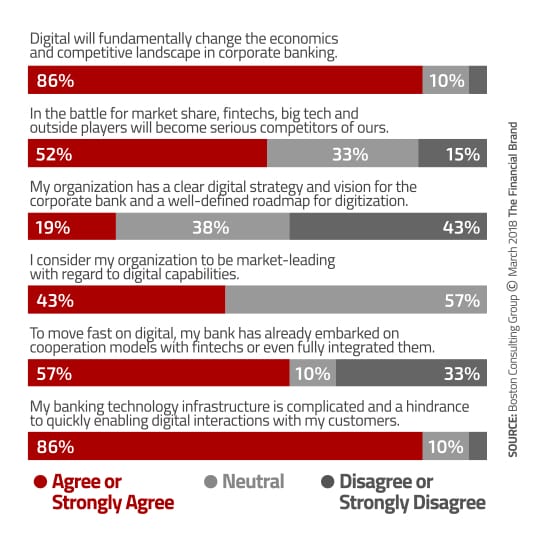

To understand this further, Boston Consulting Group carried out a study to see where banking firms stand in digital transformation.

Creating digital transformation strategy that clicks

It is the clearly evident that digital transformation is a strategic imperative for banks. Crafting a one-size-fits-all strategy for a bank is not only impossible, but leads the firm nowhere. Banks need to get used to the fact that transformation is not a day’s job, it is lengthy and iterative for most firms. Being as good as a digital native in the first attempt of transformation has been possible for very few in the industry. Here is a four step methodology to uncover the best digital transformation strategy.

- Customer is king: Simple story of any business in any industry, ‘Customer is king’. Technologies may update, trends may change, what remains constant is the ever-growing customer expectations. Consumers are obsessed with one-click choices, any transaction, irrespective of the buy. Banks too are compelled to follow and reinvent the wheel of customer journey. Boston Consulting Group explains that no two customers go through the same journey, and sketching consumer journey and segregating consumer accordingly is the biggest threat. Banks need to take into account every transaction log, call center log, to identify tentative pain points of a consumer and chart journeys. High quality experiences can be achieved by offering high quality technology solutions, being empathetic based on their behavioural analytics.

- Data is the power bank: Analytics obtained on basis of transactions and behaviour are core to serve clients as well as create strategies to target prospects. Understanding customer preference on the basis of cluster analysis have led multiple European banks to increase their revenues by 15%. The art of influencing behaviour through predictive analysis, based on the data patterns of consumer behaviour will not only intrigue customers, but engage them and build loyalty.

- Rethinking the structure: Customers entrust humans for advice and technology for transactions. The combination of these two lead to a perfect hybrid banking experience. However, the ratio of need for tech vs human is unique for every firm. A large bank with local units in rural areas would demand higher human interactions to a small bank based in a cosmopolitan city. To bring about a wholesome transformation, a firm needs multi-channel digital makeover in parallel automate back-end processes and work-flow.

- Driven by Digital: Diving into digitization at an organizational level poses variety of roadblocks.

- a. Implementing digital applications in legacy environments

- b. Slow paced implementation

- c. Resistance within organization

- d. Inculcating digital mind set throughout the firm

- e. Smaller impact on bottom line than expected

The attitude to expect a direct impact on the bottom line in the initial stages is impractical. Transformation is a time-tied process that consumes months to finally show the stats rise up. Adapting segmented transformation that encompasses short-term yet high-impact projects will achieve long-term redefined digital transformation rather than going all in at one go.

Let’s help you catch up with Digital

Creating a strategy is merely a start point for digital transformation, followed by technology and implementation. Identifying clear customer expectations, building a customer experience journey, conducting an impeccable digital operation model, alongside observing competitors, will achieve clearer goals and vision.

Banks are absolutely alert through the digital age and catching up with digital trends. If you think you hit snooze button while the world went digital, we can help you catch up and run to the forefront.

Tell us what’s keeping you from transforming digitally?