Product Innovation in the age of Connected Products and Services

It is an irrefutable fact that we now live in one of the most transformational periods in human history, and every facet of our lives is undergoing exponential change. The impact of this change is felt far and wide, across diverse domains and geographies; enterprises are struggling to deal with the dual challenges of business model disruption, and technology disruption by digital accelerating technologies such as IoT, SMAC and AI. Perhaps this challenge is most acutely felt in the software product industry, due to its inherent vulnerability to innovation and technology changes. Traditional stand-alone software products are being re-architected with micro-services and positioned as either enterprise SaaS or as part of a platform eco system.

As product businesses are grappling with these tectonic shifts, the key question confronting them is – what should be the drivers for software product strategy in such a dynamic and fast-paced business environment? Based on my extensive insights and expertise in enabling the growth of numerous enterprise class software product companies, I have reached the following conclusion:

“Contrary to established wisdom, the successful unicorns (many of them offering software products or services) of the past two decades have conclusively proven that it is no longer sufficient to excel in just one value discipline, but excellence in all value disciplines is a necessary pre-condition to become a unicorn

In this blog, I would like to elaborate on the rationale for the above cited conclusion, and outline growth strategies (based on elements of Value-Discipline modeling and Growth-Share matrix) for software product companies.

Value-Discipline Model

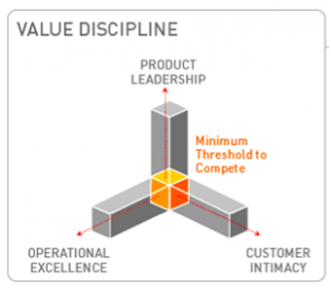

It’s been nearly quarter of a century (c. 1993) since the ground-breaking article Customer Intimacy and Other Value Disciplines by Michal Treacy and Fred Wiersema was published in the Harvard Business Review. Based on the findings of a 3-year study of 40 companies, that have far exceeded the performance expectations of similar-sized businesses, Treacy and Wiresema formulated the value-discipline model. This model proposed that enterprises must focus on 3 distinct areas or value disciplines, which are:

- Operational Excellence – a strategic approach of a business towards production and delivery of products and services at industry leading price and convenience through lean and efficient operations

- Customer Intimacy – a strategy that continuously tailors and shapes products and services to fit an increasingly fine definition of the customer

- Product Leadership – a strategy that strives to produce a continuous stream of state-of-the-art products and services through innovation and creativity

Tracey and Wiersema proposed that to be competitive, an enterprise must be competent in all three disciplines (the minimum threshold), but to be a market leader, an enterprise must excel in just any one discipline. As each of the value-discipline areas will result in the customer valuing the enterprise in a different way, the model proposed that enterprises must make a key strategic choice about which value discipline to select and focus on.

“An enterprise cannot excel in all three value disciplines because the basic enterprise culture, structures, people, facilities, processes and business models that lead to excellence in any one discipline are incompatible with achieving excellence in the others

Tracey and Wiersema have cited the phenomenal success of companies such as Home Depot, Staples, WalMart, Nike etc. as evidence that excellence in one of the value disciplines i.e. operational excellence or customer intimacy or product leadership can be a competitive differentiator and lead to sustained business excellence.

Growth-Share Matrix

The Growth-share matrix (also known as the BCG matrix) was a popular chart introduced in 1970, and widely used by enterprises as an analytical tool for portfolio management and allocation of resources.

The business units or product lines of a company are plotted based on their market share and growth rates in a scatter graph, which is split into 4 distinct segments:

- Cash Cows are product lines or business units with a high market share, that consistently generate revenues more than the expenditure spent on them, but which are growing slowly. These are assets that can be milked continuously with little or no investment.

- Dogs are product lines or units with low market share in a low-growth market, and low revenue generation. These are typically a drag on the business.

- Question marks are product lines or businesses that have a low share in a fast-growing market. These could be units with potential to grow into future stars and cash cows for the business or if they don’t succeed, could end up as dogs and become a drag.

- Stars are products or businesses with a high market share in a high-growth market. If question marks are backed up with the right investment and strategy, they could become stars. Stars need high investment to maintain the growth rate and ward off competition. When industry growth rate slows, stars could end up as cash cows due to relatively high market share.

The proponents of the Growth-share matrix stated:

“Only a diversified company with a balanced portfolio of stars, cash cows, and question marks can use its strengths to truly capitalize on its growth opportunities

Excellence across all value disciplines is a necessary pre-condition

When the Value-Discipline model was first published in 1993, future digital unicorns such as Amazon, Google, and Facebook didn’t exist. Amazon was a year away, Google was 5 years down the road, and Facebook, a good decade ahead in the future. Over the past two decades, many successful unicorns (most of them offering either a software product or service) proved that it is possible to excel in all value disciplines of operational excellence, customer intimacy, and product leadership. In fact, an unrelenting focus on delivering business value, helped them attain and sustain market leadership in an enormously competitive business landscape.

Software product companies must realize that it is no longer good enough to excel in any one value discipline, and be just competent in other disciplines. Nimble footed competitors from any corner of the world can replace even established market leaders, with a focus on all round excellence in every facet of their business. Just like any other competitive business, excellence in delivering continuous business value is a necessary pre-condition for survival for software product companies also.

Software product companies must have offer a judicious portfolio of products and services

Software product companies can learn a great deal from the successful digital unicorns of the past decade, and leverage value-disciplines and growth-share matrix to formulate their competitive strategy and roadmap. It is a fact that software product companies do have a portfolio of products encompassing multiple versions, serving diverse business functions and industry verticals. Software product companies must make a judicious assessment of the stars and potential future stars in directing investment towards the right product and portfolio mix. Software product companies can embrace value disciplines through the following strategies:

- Product ideation or digital product reinvention to enterprise SaaS and platform business models leveraging accelerating technologies

- Distributed software factories for Operational Excellence

- Professional services for Customer Intimacy

I will further elaborate on each of these growth strategies in a series of blogs. Stay tuned.

Error: Contact form not found.